Empower your customers with intelligent, automated, debt guidance solutions that simplify debt management.

Payitoff Debts

Access 95%+ of consumer debts, without requiring credentials. Our “Payitoff Debts” solution offers consistent, in-depth data designed to support the needs of large-scale operations and facilitate informed decision-making for consumers.

Find My Servicer

“Find My Servicer” provides streamlined student loan servicer discovery for consumers. With just a few pieces of information, our solution simplifies the process of finding current student loan servicers, facilitating a smoother operational workflow for enterprises via a straight-forward embeddable tool.

Payitoff Now

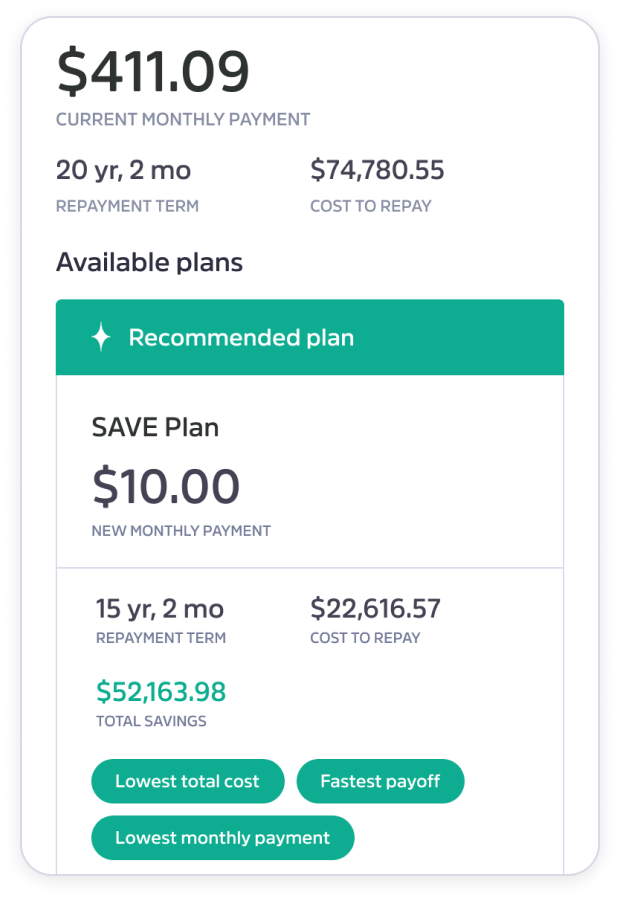

No integration needed to achieve incredible outcomes! Your customers save $240 / month* on average on federal student loan payments through “Payitoff Now”. This co-branded, no-code solution allows product leaders to get to production in an afternoon.

Check out a sample Payitoff Now experience or watch our Finovate Fall Demo

Embedded Debt Guidance

Embed this borrower experience into your app and watch as customers link their debt accounts, receive optimized insights, and take money-saving actions. Customize the experience to align to your business goals and provide customer insights by introducing financial products and ways to help your customers invest and save for retirement.

Payitoff Link

Provide customers with a frictionless way of connecting to their consumer debts. Payitoff Link allows borrowers to unlock their consumer debt portfolio using simply their phone number, date of birth and zip code. It provides partners with access to best-in-class data and facilitates continued accurate debt guidance.

Payitoff Link can be used across consumer debt verticals, unlocking a wider debt view, including credit scores. Interested? Book a meeting to find out more.

Debt Payments & Autopay

Borrowers and third parties can send payments and configure autopay for student loans at thousands of institutions through your app. Hello simple debt management and account primacy.

Digital Enrollments

Enable your customers to digitally enroll into money-saving student loan programs directly in your app. Fast approvals free up hundreds in cash flow in days vs. weeks with other providers.

Advisor Tools

Advise customers on any debt scenario with the added benefit of our expertise at your fingertips, for financial plans that foster trust and long-lasting relationships with key demos.

*Represents actual average savings of borrowers who linked their account with Payitoff and qualified for a federal repayment plan. The sample is based on an aggregated set of data representing over $1.5 billion in loan volume across 215,000+ loans on the Payitoff platform.

Enterprise-Grade Security: At the Forefront of Everything We Do.

With SOC 2 compliance, GDPR, and CCPA adherence, our solutions are designed to protect data at every level. Our comprehensive security measures and compliance certifications meet the highest enterprise security standards.