Advising On Income-Driven Repayment

Federal student loan repayment is complicated. There are tons of income-based repayment options and it’s difficult for any financial advisor to navigate.

- Is my client eligible for any federal programs?

- Which loans qualify for these programs?

- What are the tradeoffs of Income-Based Repayment vs Pay-As-You-Earn?

As a financial advisor, every detail of income-driven repayment is important because they each have a profound impact on your client’s financial outcome.

Quick example: choosing Revised Pay-As-You-Earn (REPAYE) over Pay-As-You-Earn (PAYE) may be a great idea due to the generous interest subsidization, but what if your client needs the limit on interest capitalization and monthly payment for cash flow reasons?

These are difficult decisions to make. Too often, financial advisors have to trudge through the mud to get answers. Not anymore!

Income-Driven Comparison

Payitoff was built to minimize complexity and answer the tough questions around student loans, so naturally we were inclined to make Income-Driven Repayment (IDR) as transparent as possible.

Once you’ve added a little information about your client, our system automatically checks whether the loans and client profile match IDR programs. You’ll see a new suggestion when building out a plan:

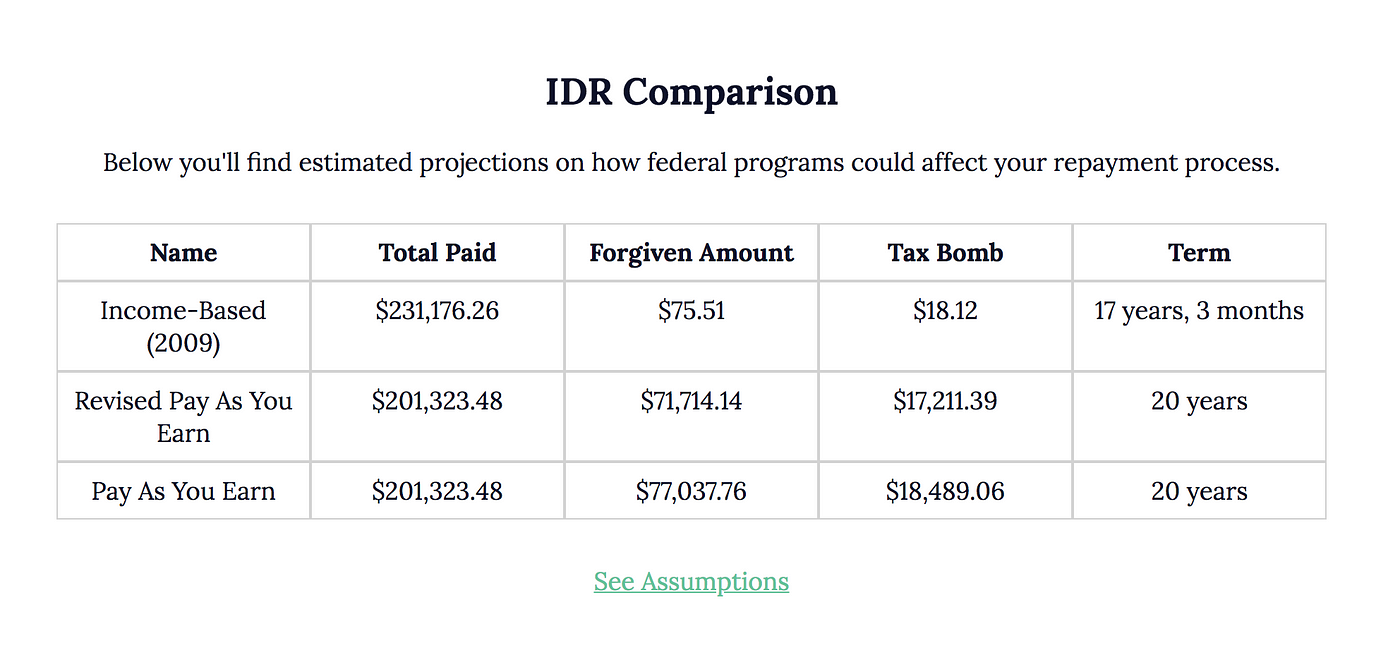

When generating a new report, you’ll see a matrix that looks like this:

We factor in the exact details of each program, including any subsidization behavior and interest capitalization nuances.

In our example above, you’ll see that the client spends the same over the life of REPAYE and PAYE, but ends up with a slightly worse tax bomb at the end of the term due to differences in government subsidies.

In the Income-Based Repayment case, the total paid is much larger because they are on the older IBR plan, which utilizes 15% more of their discretionary income (vs 10%) with a 5 year longer term. In this scenario, the client would be paying more but be debt free three years sooner.

PSLF

Public Service Loan Forgiveness is a big question mark for many financial advisors. If you’re considering IDR for your clients, it’s important to run a PSLF scenario so your client can view the trade offs of working at a for-profit vs non-profit organization.

Eligibility

First off, it can be difficult to tell whether your client qualifies for PSLF or if they ever worked in a place that did.

Within Payitoff, you can now search to see if your client’s employer qualifies as a 501(c)(3), which are eligible organizations for the plan:

Execution

When you get into PSLF, it’s crucial that your client stays true to it. You’ll want to have annual check-ins to ask how repayment is going and if it matches the plan. Under PSLF, your client needs 120 qualifying payments to elect tax-exempt forgiveness.

You can export the PSLF report for future reference when discussing progress with accumulating these 120 payments.

Public Service Loan Forgiveness may seem like a large unknown for many advisors, but it absolutely has huge benefits. If your client is a doctor in residency working in a non-profit hospital, this choice can be a big factor on their financial well being.

What’s next?

Right now, the software makes a fair amount of assumptions about income growth and family size. We want to introduce the following to our IDR tool:

- Income Prediction: plan multiple income scenarios and family sizes so your client can see how life changes affect their repayment and goals.

- IDR Timeline: similar to our prepayment forecast, we want every IDR plan to have an associated timeline so the client can see exactly how their payments progress over time.

If you’re in our beta, you have access to this right now. If not, we’ve opened up a few spots so you can try it out and let us know what you think. We’d love to hear your thoughts!

···

Thanks to Nicolle Matson